Korea Turns Corporate Networks into Export Infrastructure for SMEs

South Korea is expanding a policy approach that links the global infrastructure of large corporations with the export ambitions of…

South Korea is expanding a policy approach that links the global infrastructure of large corporations with the export ambitions of…

Korea’s startup funding activity in early March highlights where venture capital is concentrating after a year of recalibration. Recent investments…

South Korea’s startup policy is entering another operational phase. After committing capital and setting strategic direction for 2026, the government…

Raising venture capital in Asia now demands more than a compelling idea. Investors are asking sharper questions about execution, defensibility,…

South Korea’s AI ambitions are increasingly moving beyond model development and into the infrastructure needed to run them. At the…

A startup export strategy can look global on paper and still fail at the point of movement. Korea’s latest Middle…

South Korea’s AI ambitions are increasingly moving beyond model development and into the infrastructure needed to run them. At the…

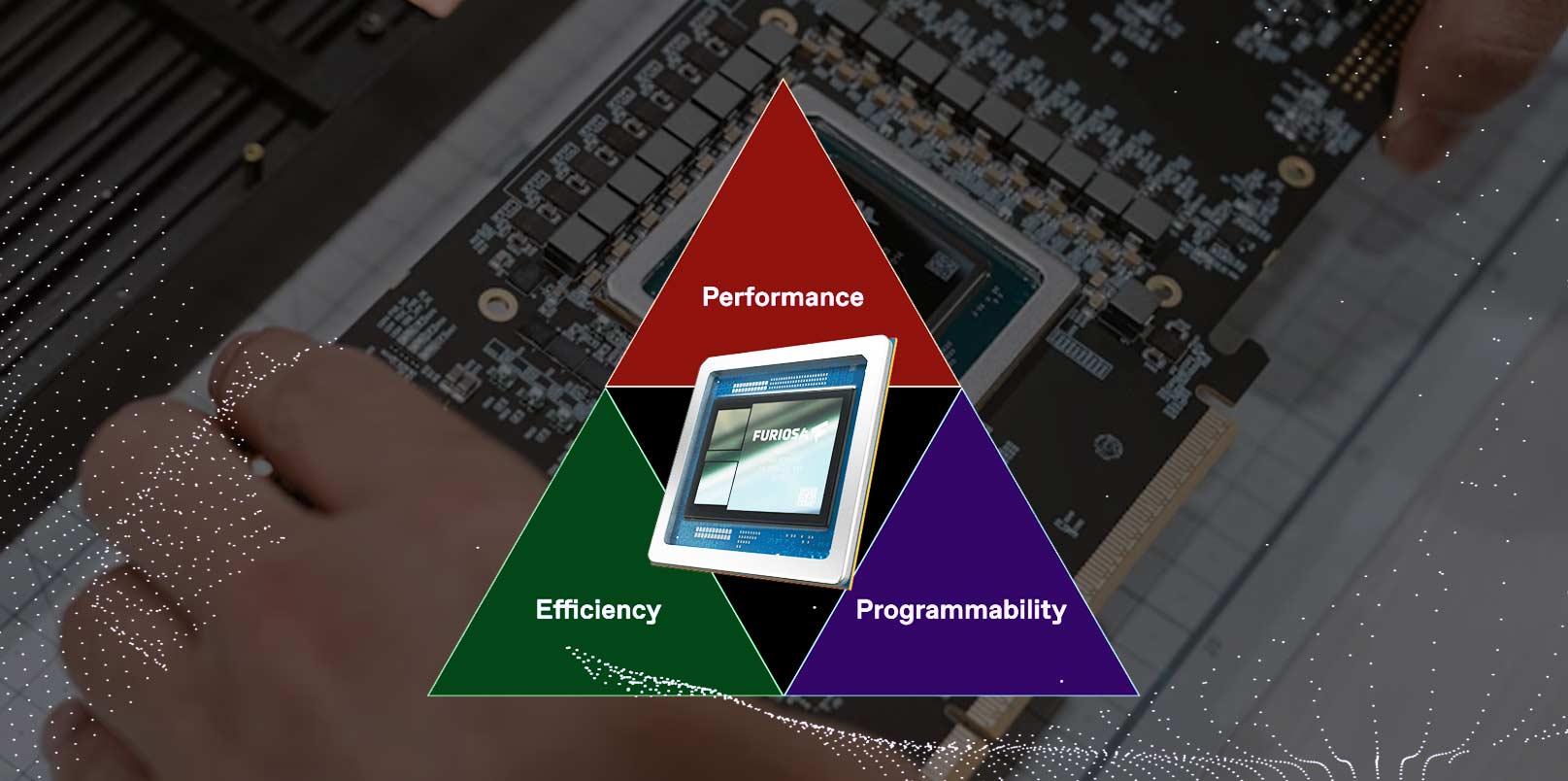

AI chip ambition is easy to celebrate at the prototype stage. It becomes harder when wafers turn into shipments, and…

South Korea’s sovereign AI effort is entering a new stage. After months of benchmark evaluations under the government’s independent AI…

As South Korea’s AI Basic Act enters enforcement, regulatory clarity is colliding with a hard reality: synthetic media threats are…

South Korea’s main SME umbrella organization is facing an internal governance debate that is beginning to attract national attention. The Korea Federation of SMEs (KBIZ) recently discussed removing term limits for cooperative chairpersons and federation executives following a legislative amendment proposal in the National Assembly. While the proposal is framed as an operational reform, the debate is exposing deeper tensions about leadership concentration, institutional transparency, and governance stability inside Korea’s SME representation system. KBIZ Briefing Sparks Controversy After February General Assembly According to Korean media reports, the Korea Federation of SMEs held its regular general assembly on February 26 in Yeouido, Seoul, approving five formal agenda items before closing the meeting. Immediately after the assembly ended, members reportedly held a separate briefing session discussing a proposed amendment to the Small and Medium Enterprise Cooperatives Act. The bill was introduced in late 2025 by Democratic Party lawmaker Jung Jin-wook. The proposed amendment includes provisions that would remove term limits for: the KBIZ chairman cooperative chairpersons within member organizations federation executives Under the current legal framework: The KBIZ chairman may serve one…

When a startup secures 1 million USD in state-backed liquidity only to have its CEO quietly convicted of tax fraud…

Korea has secured the law. But the money? No, not yet. And for a country positioning semiconductor at the center…

Manufacturing AI is no longer a future narrative in Korea. It is becoming a funding structure. With KRW 87 billion…

Raising venture capital in Asia now demands more than a compelling idea. Investors are asking sharper questions about execution, defensibility, and market timing. AsiaStartupExpo Q1 2026 arrives against that backdrop, bringing founders and investors into a short, dialogue-focused pitch forum designed to mirror real fundraising conversations. The virtual event offers a window into how cross-border capital and investor expectations are evolving across Asia’s startup ecosystem. AsiaStartupExpo Q1 2026 Brings Asian Founders and Global Investors Together Asia’s startup ecosystem is entering a more disciplined capital environment. Investor attention has become harder to secure, and founders are under increasing pressure to articulate clearer market narratives. AsiaStartupExpo Q1 2026, scheduled for March 18, reflects that shift. The virtual forum brings together startups and investors for a structured pitch and discussion session designed to mirror real fundraising conversations across the region. The event is jointly organized by AsiaTechDaily, beSUCCESS, KoreaTechDesk, and IndiaTechDesk. Running from 2:00 PM to 4:30 PM (KST) / 1:00 PM to 3:30 PM (SGT), the quarterly forum will feature short startup pitches followed by live investor dialogue, allowing founders to present…

Korea’s startup ecosystem is redefining what capital means. At the 2026 Startup Investor Summit in Busan, industry leaders, investors, and…

Korea’s startup ecosystem is entering a new chapter where capital is no longer defined by money alone. As investment patterns…

For years, Korea’s startups have arrived at CES 2026 to prove they belong on the global stage. This year, they…

In an era when “AI innovation” is often reduced to marketing noise, Estonia-based ArbaLabs stands out for what it refuses…

In a country leading the world in robotics and AI adoption, IDOLL Robotics stands at the edge of a new…

The promise of AI in healthcare often feels distant—powerful in theory, but uneven in reach. Vyuhaa Med Data, an India-based…

South Korea’s open innovation model is becoming increasingly structured. In Seoul, a new platform is bringing major corporations and startups…

Korea Technology Finance Corporation (KIBO) is transforming its flagship Venture Camp into a national-scale accelerator initiative that blends public policy,…

Korea’s policy finance system is entering a new phase of scale and precision. The Korea Development Bank (KDB) has launched…

As Korea recalibrates its startup policy toward deeper integration between capital, technology development, and overseas expansion, the role of intermediary…

South Korea’s largest startup association has entered a leadership transition at a time of policy recalibration. Korea Startup Forum has…

In today’s fast-evolving digital landscape, innovation is key to staying ahead. Singapore’s Infocomm Media Development Authority (IMDA) has taken a…

In a first of its kind instance in South Korea’s legal industry, prominent law firm Shin & Kim has implemented…

[the_ad id=”18508″]

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

You can see how this popup was set up in our step-by-step guide: https://wppopupmaker.com/guides/auto-opening-announcement-popups/

dgdfgfdgdf