For the first time since its establishment in 2001, Korea’s Pension Fund Pool is stepping into venture capital. With a joint ₩40 billion ($29 million) commitment alongside the Korea Fund of Funds, the move signals a major policy shift aimed at strengthening startup exits and secondary markets. For founders, investors, and policymakers alike, this marks a pivotal moment in Korea’s journey toward productive finance.

Pension Fund Pool’s First Venture Step in Two Decades

South Korea is opening a new chapter in institutional capital participation. On August 27, the Ministry of SMEs and Startups (MSS) announced that the Pension Fund Pool (via the Trade Insurance Fund) and the Korea Fund of Funds will each commit ₩20 billion, jointly establishing a ₩40 billion (~approximately $29 million) “LP First Step Fund.”

This is the first-ever venture investment since the Pension Fund Pool system was introduced in 2001 to manage surplus pension assets in a consolidated manner. For two decades, the pool — including the Trade Insurance Fund — had never allocated capital to venture vehicles.

The LP First Step Fund was newly created in 2025 to attract institutional investors with no prior experience in venture fund commitments. It lowers entry barriers by offering enhanced incentives, such as:

- Loss protection: government shoulders initial losses,

- Profit transfers: redistribution when returns exceed expectations,

- Equity purchase rights: the ability to acquire shares of portfolio companies at pre-set prices,

- Free sector choice: first-time LPs can define their own investment domains.

Targeting Secondary Markets to Boost Exits

The ₩40 billion (~$ 29 million) parent fund was completed on August 18, following review by the Fund Pool Steering Committee and approval by the Trade Insurance Fund’s Asset Management Committee.

Through this vehicle, MSS plans to select managers to operate an estimated ₩57 billion (~$41 million) in sub-funds, with investments concentrated in the secondary market — transactions involving the resale of existing venture stakes. By aligning with the Trade Insurance Fund’s preferences, the focus on secondary deals is expected to invigorate Korea’s exit market, a long-standing challenge for the ecosystem.

Venture Funds as “Productive Finance”

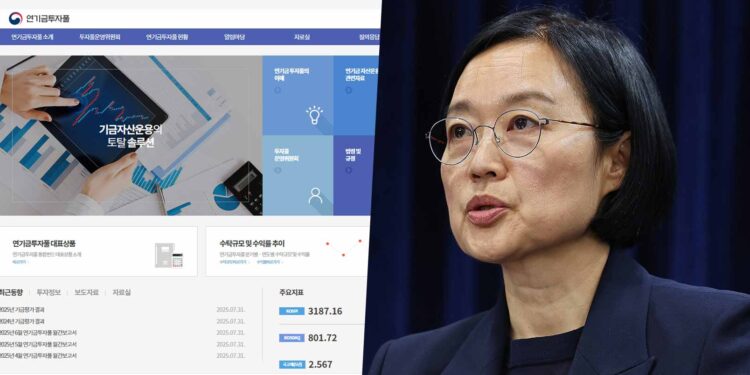

SMEs and Startups Minister Han Seong-sook underscored the strategic significance of the initiative:

“Venture funds are a key instrument of productive finance — investing in innovative ventures and startups, supporting their growth, and distributing returns back to LPs.”

Minister Han also emphasized that the Korea Fund of Funds has demonstrated stable performance even in public-interest-heavy sectors, generating over 8% on average annually, and more than 10% over the past five years.

Among 308 sub-funds worth ₩8.9 trillion (~$6.4 billion) that have been liquidated, the internal rate of return (IRR) has averaged 8.9%.

“With the LP First Step Fund, the Pension Fund Pool has opened its first pathway into productive finance. The Fund of Funds will continue to strengthen its role as a venture investment platform, ensuring more public and private capital flows into the venture market.”

Unlocking Korea’s Institutional Capital

This milestone addresses one of the venture industry’s longest-standing goals: bringing in Korea’s large-scale institutional funds to strengthen venture financing capacity.

By channeling pension-related surplus capital into structured vehicles, Korea is seeking to:

- Expand the investor base for startups,

- Stimulate secondary transactions to improve liquidity and exits,

- Help build confidence in venture capital as a viable institutional asset class,

- Support more sustainable growth of the startup ecosystem.

The move also aligns with Korea’s broader push to reposition productive finance at the center of economic policy — leveraging both public and private capital to accelerate innovation.

Stronger Direction and Sustainability for Korea’s Startup Ecosystem

Korea’s first pension fund-backed venture investment marks a symbolic and practical step toward deepening the capital base for startups.

With the Fund of Funds acting as a stabilizing platform and the Pension Fund Pool entering venture capital for the first time since its inception, the initiative signals a stronger future for secondary markets, exits, and long-term sustainability of Korea’s startup ecosystem.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.