In Korea’s venture capital market, the type of investor backing a startup can determine whether a founder’s personal assets remain protected — or risk exposure in a business collapse. A dual VC licensing system, uncommon among major VC hubs, means founder protections vary dramatically depending on which regulator oversees the deal, creating a legal gap with real consequences for entrepreneurs and investors alike.

Korean VC Licensing Rules: Why the Type of Investor Matters More Than You Think

In most global venture capital hubs — including the United States, UK, Singapore, and Israel — the legal protections founders receive do not depend on who invests in their startup. In South Korea, it can make all the difference.

Two separate laws — each enforced by different ministries — govern the nation’s venture capital industry. While both license investors engaged in the same fundamental business of backing high-growth companies, the rules diverge sharply when it comes to founder liability. This dual regulatory, long overlooked, is now back in focus as cases emerge of founders facing personal financial ruin despite reforms designed to prevent it.

Two Laws, Two Regulators — and a Legal Gap

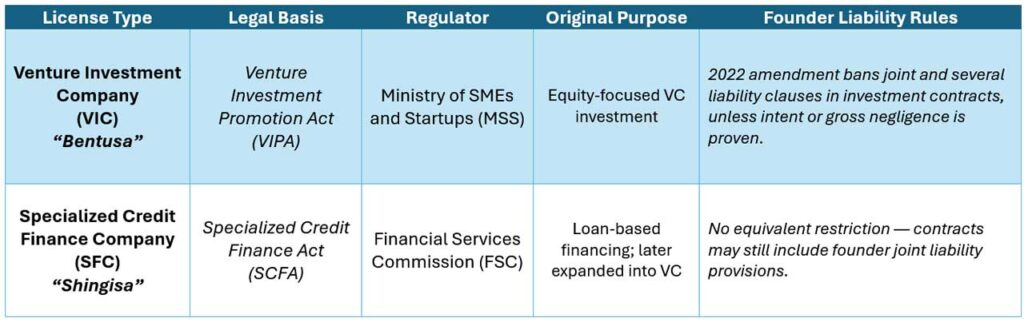

Korea’s venture capital industry operates under two parallel licensing systems:

Under the VIPA framework, startup founders are shielded from “joint and several liability” clauses unless they act with intent or gross negligence. This change came in 2022, when the MSS amended the VIPA’s enforcement decree to align venture funding with modern risk-sharing principles.

The SCF firms, however, are regulated under the FSC and the SCFA — which has not been updated to match the MSS protections. This means a startup founder could sign an investment agreement with a SCF-backed VC and face personal liability for company debts, even when business failure is beyond their control.

Why the VC Licensing System Matters for Founders and Investors

For Korean startup founders, this is more than a legal technicality — it’s a structural risk that can follow them long after their startup shuts down. Investment contracts often span years, and the type of VC license held by an investor determines whether personal assets might be on the line in the event of business failure.

For investors, the dual system creates market inefficiency. Founders — particularly first-time entrepreneurs — may be wary of accepting capital from certain license types, not because of valuation or strategic fit, but because of the legal exposure attached.

Dual VC Licensing System: A Market Structure Unique to South Korea

Globally, most venture capital markets operate under a single licensing regime or a harmonized regulatory framework, ensuring consistency in contract standards, investor rights, and founder protections.

Korea’s dual VC licensing system is the result of historical sector segmentation:

- Venture Investment Company firms emerged from policies to stimulate startup equity investment.

- Specialized Credit Finance Company firms evolved from non-bank finance companies with a focus on loans, later branching into equity-like investments.

As noted by Money Today, this dual structure has no direct equivalent in other leading VC markets, and the fragmentation adds complexity for both domestic and foreign players.

Calls for Reform — and Why It’s Complicated

Some in the startup and investment community argue for integrating VIPA and SCFA into a single regulatory framework. They point to reduced founder risk, simpler compliance, and stronger investor confidence.

However, policymakers caution that the two license types were built for different purposes. SCF firms still engage in loan financing, and their capital adequacy rules, risk models, and oversight requirements differ from those of VIC firms.

Therefore, merging the systems would require aligning laws, supervisory structures, and financial standards.

The Global Competitiveness Angle

If Korea aims to position itself as a top-tier global startup hub, regulatory clarity will be critical. International investors value predictable, standardized contract terms. Founders, both local and foreign, need assurance that accepting venture funding will not expose them to disproportionate personal risk.

The current dual VC licensing system in South Korea, while rooted in history, could deter both groups. Aligning rules on founder liability across all VC license types would be a first step toward creating a level playing field that meets global market expectations.

Navigating Korea’s Dual VC Licensing System

Ultimately, for Korea’s startup ecosystem, the dual VC licensing structure is more than a bureaucratic quirk — it’s a fault line that shapes capital flows, founder decision-making, and the country’s global competitiveness.

Until the gap between the MSS and FSC regimes is addressed, founders and investors will need to navigate the fine print as carefully as the pitch deck.

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.