South Korea’s Ministry of SMEs and Startups (MSS) has taken a decisive step to strengthen the nation’s position in AI and deep tech innovation. In its second 2025 call for fund formation under the national Mother Fund program, MSS received 98 venture capital (VC) fund proposals totaling ₩1.6 trillion KRW (~$1.2 billion USD)—the largest to date. Of these, 61 proposals specifically targeted the newly introduced NEXT UNICORN Project, a specialized track for scale-stage investment in emerging AI and deep tech startups.

The strong response reflects a strategic intensification of Korea’s public-private startup investment model, with this round placing greater emphasis on larger, more focused capital deployment to nurture high-growth technology companies with global potential.

Background: The Mother Fund’s Role in Korea’s Startup Investment Landscape

The Mother Fund, managed by Korea Venture Investment Corp (KVIC) under the Ministry of SMEs and Startups, serves as Korea’s national fund-of-funds for venture capital formation. Since its inception, it has played a central role in de-risking early-stage investment through public-private co-investment structures.

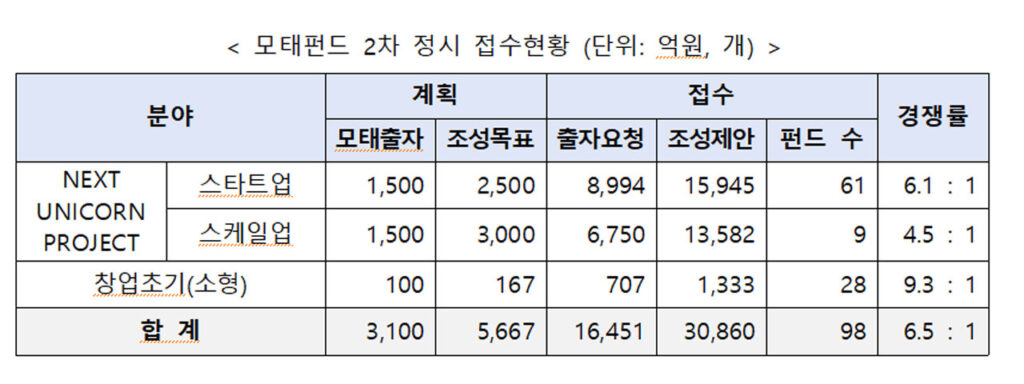

In its second 2025 funding round, the ministry announced it would selectively invest ₩310 billion KRW (~$240 million USD) from the Mother Fund to form around 15 private VC funds. These funds will combine public and private capital to deploy up to ₩600 billion KRW (~$460 million USD) in total.

What stands out in the 2025 cycle is the sharp rise in competition. A total of 98 fund proposals were submitted, translating to a 6.5:1 competition ratio for approximately 15 fund slots available, signaling heightened investor interest in deep tech and AI-focused fund formations.

What Is Korea’s NEXT UNICORN Project?

Introduced through the second supplementary budget (추경) passed by Korea’s National Assembly in June 2025, the NEXT UNICORN Project is a specialized funding track within the Mother Fund targeting high-growth AI and deep tech startups.

Of the ₩310 billion KRW public capital allocation, ₩300 billion KRW (~$231 million USD) is earmarked specifically for the NEXT UNICORN Project. The initiative is designed to concentrate investment into Korea’s most promising startups, supporting them through each growth stage with larger, more strategic funding.

The program aims to respond to intensifying global competition in AI and deep tech, particularly as countries race to localize core technologies. By boosting Korea’s domestic startup pipeline, the government hopes to develop companies with a global-first mindset and unicorn potential.

Deep Tech Investment Demand Surges Among VCs

A breakdown of the submitted fund proposals reveals that 61 of the 98 applications targeted the NEXT UNICORN Project startup track—an overwhelming majority that underscores investor confidence in Korea’s emerging deep tech sector.

Of the total proposals, 61 funds applied under the NEXT UNICORN Project track—resulting in a 6.1:1 competition ratio. These proposals collectively sought approximately ₩900 billion KRW in public matching funds.

The government’s analysis aligns with broader market signals. Media reported MSS data that investment in Korea’s deep tech sectors grew 34% year-over-year in 2024, while AI investment surged 75%, surpassing ₩1 trillion KRW (~$769 million USD) for the first time.

Enhanced Investment Strategy: Larger Checks, Stronger Alignment

One defining feature of the NEXT UNICORN Project is its shift toward scale-oriented investment. The NEXT UNICORN Scale-up Fund will increase average investment per company to over ₩10 billion KRW (~$7.7 million USD), enabling more concentrated scale-stage capital.

The project also strengthens alignment between government support programs and venture investment.

Fund managers must invest at least 30% of their capital into startups that not only joined government-backed programs but also achieved measurable results and received public institutional recommendations.

Korea’s NEXT UNICORN Project: Strategic Expansion Planned Through 2026

Although the 2025 round is being treated as a pilot phase, the Ministry of SMEs and Startups has already confirmed plans to expand the NEXT UNICORN Project in 2026. The program is expected to become a cornerstone of Korea’s AI and deep tech industrial policy—alongside existing initiatives like the Global Fund, which requires international VCs to invest in Korean startups.

Unlike the Global Fund, which imposes specific reinvestment ratios on foreign VCs, the NEXT UNICORN Project emphasizes domestic deployment through larger, strategic checks without foreign allocation concerns.

Minister Han Seong Sook: “We Must Act Urgently to Lead AI and Deep Tech”

Minister Han Seong Sook emphasized that Korea cannot afford to take a passive role in the global race for AI and deep tech dominance. “To foster unicorns that can lead in global markets, we must move beyond fragmented investments and focus our capital on the most promising companies,” she said.

“The launch of the NEXT UNICORN Project through this year’s supplementary budget reflects our government’s urgency to support domestic startups in securing early leadership in the fast-changing global AI and deep tech landscape,” she added. “We will accelerate the fund deployment to ensure that actual investments are made within the year.”

Broader Ecosystem Significance of NEXT UNICORN Project

The NEXT UNICORN Project reinforces a growing national strategy in Korea to build sovereign capability in AI, semiconductors, and advanced technologies. It complements existing programs like TIPS and the Global Fund by carving out a targeted investment channel specifically focused on nurturing future unicorns through scalable, domestic VC infrastructure.

With global venture capital still recovering from a two-year downturn, Korea’s targeted deep tech funding strategy could serve as a model for other countries balancing national innovation goals with startup sustainability.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.