New strategic focus on AI, Climate Tech, and Secondaries expands Korea’s Global Fund initiative.

South Korea’s Ministry of SMEs and Startups has announced the selection of 13 global venture capital (VC) firms to manage the 2025 Korea Global Fund, a landmark government-backed initiative aimed at strengthening Korean startups’ access to global capital, networks, and scaling expertise.

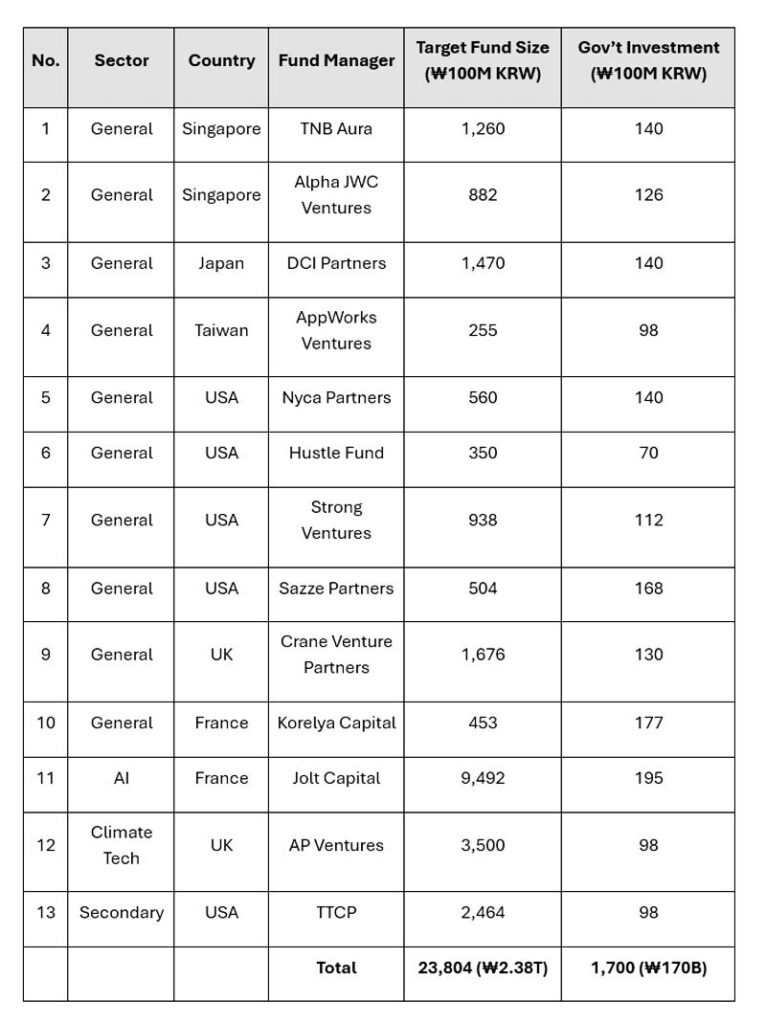

The selected VC firms will establish funds totaling ₩2.4 trillion KRW (approx. USD 1.84 billion), with ₩170 billion KRW (approx. USD 130 million) coming from the South Korean government’s “Mother Fund,” managed by the Korea Venture Investment Corp. (KVIC). A minimum of ₩270 billion KRW (approx. USD 207 million) from these funds must be directly invested into Korean startups.

About the Korea Global Fund

Launched in 2013, the Korea Global Fund is a government initiative that partners with foreign VCs to co-invest in Korean startups. The program’s unique structure allows international fund managers to receive government anchor investment, provided they match or exceed that amount through reinvestment into Korean companies.

So far, the program has supported:

- 652 Korean startups

- Over ₩13 trillion KRW (approx. USD 9.3 billion) in total investment since inception

New Strategic Directions for 2025

For the 2025 cohort, the Global Fund introduces three new priority sectors:

- Artificial Intelligence (AI)

- Climate Tech

- Secondary Investments (supporting liquidity for late-stage startups)

These additions reflect South Korea’s ambition to align its innovation capital with emerging global technology trends, and to address challenges such as the Series B+ funding gap for Korean companies.

2025 Selected Global Fund Managers

Highlight: Jolt Capital (France) leads the AI mandate with a ₩949.2 billion fund—the largest AI-focused VC fund ever linked to Korea’s ecosystem.

Fund Formation Timeline

- Fund formation deadline: Within 6 months of official contract signing on September 5, 2025

- Extension: A one-time extension of up to 6 additional months may be granted after formal review

Government Statement

“The Global Fund is not just financial support—it’s a bridge connecting Korean startups with global venture ecosystems,” said Han Seong-sook, Minister of SMEs and Startups. “We will continue to expand this program to position South Korea among the world’s top four VC hubs, and to accelerate Korean startups’ access to global capital and markets.”

Summary Highlights

- Total fund formation: ₩2.4 trillion KRW (~$1.84B USD)

- Mandatory investment in Korean startups: ₩270 billion KRW (~$207M USD)

- Global VCs selected: 13 firms from 6 countries

- Strategic sectors: AI, Climate Tech, Secondary Investment

- Largest individual fund: Jolt Capital (AI), ₩949.2 billion

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.