South Korea’s venture capital market showed steady growth in the first half of 2025, according to the Ministry of SMEs and Startups (MSS), with investment volumes rising for a second consecutive year and private-sector funding reaching second-highest first-half total on record. The period also marked the debut of two new unicorns: FuriosaAI in deeptech and BENOW in K-beauty, reflecting the ecosystem’s ability to produce globally competitive startups across both technology and consumer sectors.

South Korea’s Venture Investment Reaches ₩5.7 Trillion, Up 3.5% YoY

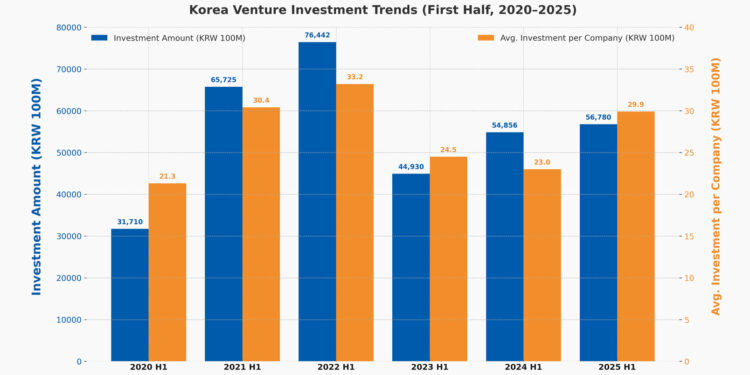

According to data from the Ministry of SMEs and Startups (MSS), new venture investment in the first half of 2025 totaled ₩5.678 trillion (~US$4.2 billion), a 3.5% year-on-year increase.

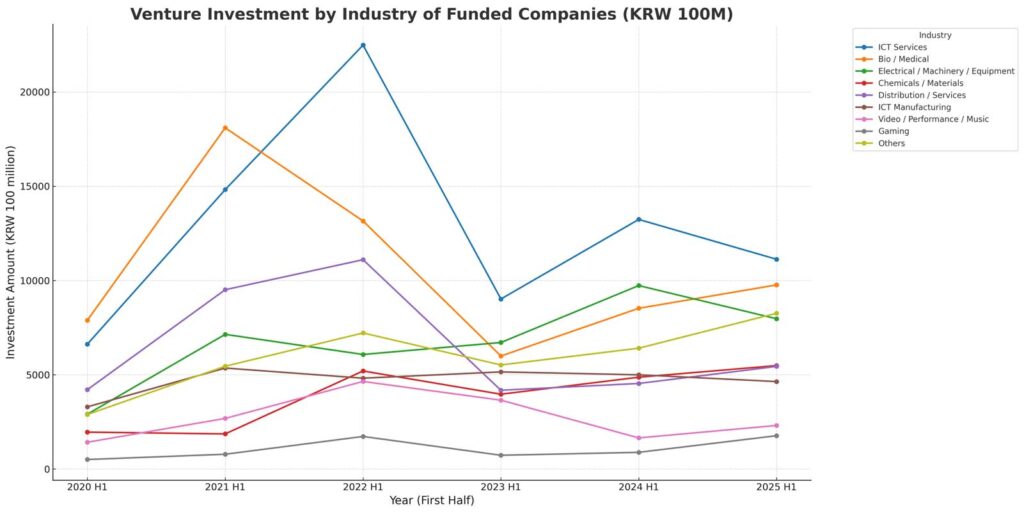

The bio and medical sector posted the largest absolute growth, adding ₩124 billion in new capital, while the gaming sector recorded the highest growth rate, nearly doubling (+99.8%) compared to the same period last year.

High-value deals also became more frequent. Among companies funded by venture capital firms and associations, those securing investments of ₩30 billion or more increased from one in H1 2024 to five in H1 2025. As a result, the average investment per company rose by 29.7% to ₩2.99 billion.

Venture Fund Formation Hits ₩6.2 Trillion – Private Sector Drives Growth

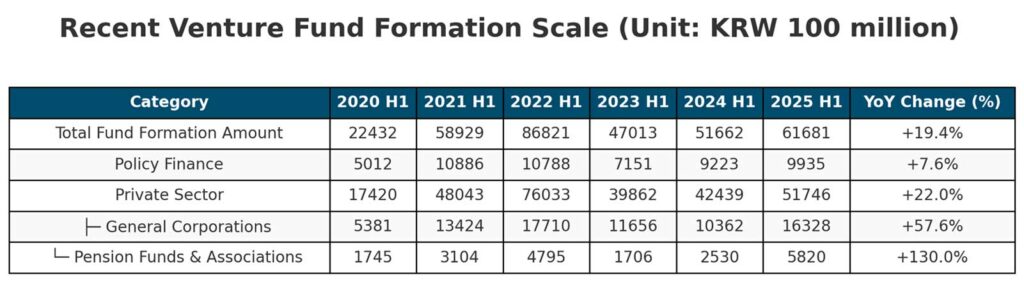

Venture fund formation reached ₩6.168 trillion (~US$4.6 billion) in H1 2025, up 19.4% YoY—the second-highest first-half result on record.

Private-sector commitments accounted for 83.9% of total formation, rising 22% year-on-year. The strongest growth came from pension funds and mutual aid associations (+130%) and general corporations (+57.6%), signaling deepening institutional engagement in Korea’s venture asset class.

Policy finance commitments also grew, increasing by 7.6% compared to the same period last year.

Two New Unicorns: FuriosaAI and BENOW

Two companies crossed the ₩1 trillion valuation mark in H1 2025:

- FuriosaAI – Founded in April 2017, the fabless semiconductor company designs and develops AI compute chips (NPUs) for non-memory applications, positioning itself in the global deeptech race for AI hardware.

- BENOW – Established in August 2018, the cosmetics manufacturer operates the skincare brand NUMBUZ:N and makeup brand Fwee, underscoring the global pull of K-beauty as an investable asset class.

Their emergence reflects the Korean startup ecosystem’s breadth—delivering unicorns in both advanced technology and high-growth consumer markets.

Venture Growth and Sector Diversity Elevate Korea’s Global Startup Position

The H1 2025 data points to a maturing Korean startup ecosystem capable of attracting large-scale capital across sectors. The combination of Korean venture investment growth, surging private sector venture funding, and the rise of AI and K-beauty global competitiveness strengthens Korea’s position in both innovation-driven and brand-driven markets.

By producing high-value startup investments in fields as diverse as AI semiconductors and cosmetics, Korea demonstrates its ability to translate sector expertise into globally competitive businesses.

Minister Han Seong-sook noted,

“The year-on-year increase in venture investment, coupled with the significant rise in private capital commitments driving fund formation, is a highly positive sign. The government will continue to ensure that promising companies can grow through venture investment and advance into global markets.”

🤝 Looking to connect with verified Korean companies building globally?

Explore curated company profiles and request direct introductions through beSUCCESS Connect.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.