In Korea’s startup ecosystem, one funding instrument dominates early-stage investment: Redeemable Convertible Preferred Shares (RCPS). While designed to protect investors, RCPS investment contracts often carry high-interest repayment clauses that can weigh heavily on startup founders if growth stalls. Recent disputes and rehabilitation cases are drawing attention to how these practices affect entrepreneurial resilience and why calls for reform are gaining momentum.

Understanding RCPS Investment and Their Prevalence in Korean Startup Funding

In Korea’s startup investment landscape, Redeemable Convertible Preferred Shares (RCPS) remain a dominant funding instrument, particularly for companies moving beyond seed capital into Series A stages.

RCPS structures give investors the right to demand repayment of their principal, often with added interest, if milestones such as follow-on funding or an IPO are not achieved within the agreed period.

Industry experts estimate that 70–80% of early-stage deals in Korea involve RCPS, making it the standard rather than the exception. While RCPS offers investors security, it often leaves founders vulnerable if growth targets are missed.

For startups facing slower-than-expected market traction or capital shortages, repayment clauses can create unsustainable debt burdens that hinder a second attempt at growth.

How RCPS Investment Impacts Startups: The Cost of High-Interest Contracts

Contracts reviewed by incubators and university startup centers reveal clauses demanding repayment with interest rates exceeding 7% annually, typically within three years of investment. For founders, this converts what is presented as equity investment into a structure resembling high-interest debt.

Because these repayment terms are legally embedded in contracts, disputes almost always favor investors when taken to court. The result is a growing number of founders who find themselves unable to restart after failure, weighed down by repayment obligations rather than positioned for reinvention.

Case Study: Urbanbase and Shinhan Capital

A recent dispute between Urbanbase, a Korean 3D spatial data startup, and Shinhan Capital illustrates the risks.

Facing business difficulties, Urbanbase entered court receivership in December 2023. Shinhan Capital, concluding that it could not recover funds through a share sale, filed suit against the founder to enforce repayment under RCPS terms.

In the first-instance ruling, the court sided with Shinhan Capital, leaving the Urbanbase founder liable for approximately ₩1.2 billion (about US$900,000) in repayments.

Urbanbase CEO Ha Jin-woo stated that Shinhan Capital had initially considered withdrawing the lawsuit during last year’s public debate over aggressive debt collection practices. However, as public attention faded, the firm announced its intent to enforce stock repurchase rights across its entire portfolio.

CEO Ha Jin-woo recalled,

“Last year, when excessive debt collection practices sparked public controversy, Shinhan Capital privately suggested it might withdraw its lawsuit, admitting its actions were improper. But as public attention faded this year, the firm reversed course and announced it would enforce stock repurchase rights across all its portfolio companies, including Urbanbase.”

The case has drawn attention to the imbalance of power between investors and startups under RCPS frameworks.

Challenges in Startup Rehabilitation

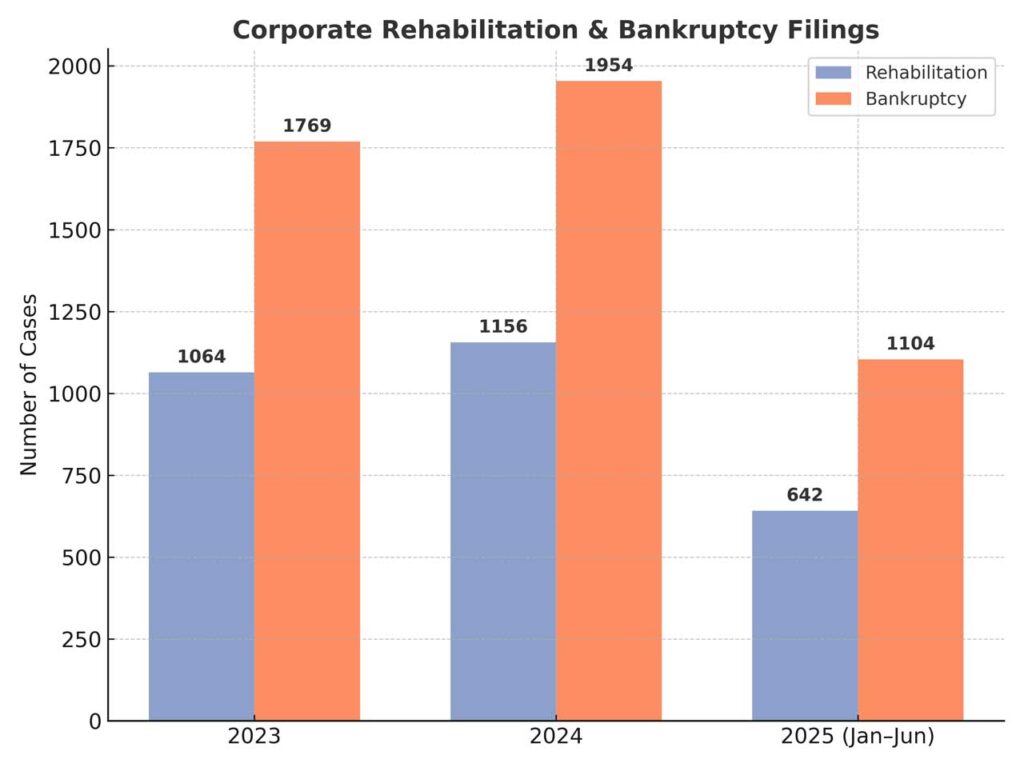

The RCPS issue overlaps with broader difficulties in Korea’s corporate rehabilitation process. Once-prominent startups such as TMON, Wemakeprice, Jeong Yook Gak, Balan, and Watcha have all entered restructuring due to financial strain and failed fundraising. Yet, even with court-approved rehabilitation, many find recovery nearly impossible.

Yoon Byung-woon, head of the Korea Corporate Rehabilitation Association, told Seoul Economic Daily,

“Unless a court’s rehabilitation approval is immediately followed by a credit rating upgrade, true recovery is nearly impossible. Even after approval, financial institutions continue to assign distressed firms a low credit rating (D), making loans inaccessible. Startups that want to secure supply contracts and need performance bonds are often denied issuance due to their low credit standing.”

This cycle leaves rehabilitated startups unable to rebuild, even after surviving the legal process.

Toward a Healthier Funding Landscape

While RCPS protects investors, the structure highlights the tension between capital security and entrepreneurial resilience. Industry voices suggest that moving toward common stock investment practices could better balance interests, allowing founders space to recover and innovate while still giving investors equity upside.

As more Korean startups enter restructuring, the debate over RCPS is becoming increasingly urgent. The question remains whether the ecosystem can evolve toward funding practices that balance risk more fairly between entrepreneurs and investors.

– Stay Ahead in Korea’s Startup Scene –

Get real-time insights, funding updates, and policy shifts shaping Korea’s innovation ecosystem.

➡️ Follow KoreaTechDesk on LinkedIn, X (Twitter), Threads, Bluesky, Telegram, Facebook, and WhatsApp Channel.