Korea’s startup ecosystem is thriving because of the support it gets from the Korean government and its agencies. Seoul Fintech Lab is a leading fintech startup supporting institution fully funded by the Seoul Metropolitan Government. The organization supports startups through various incubating and accelerating programs throughout the year.

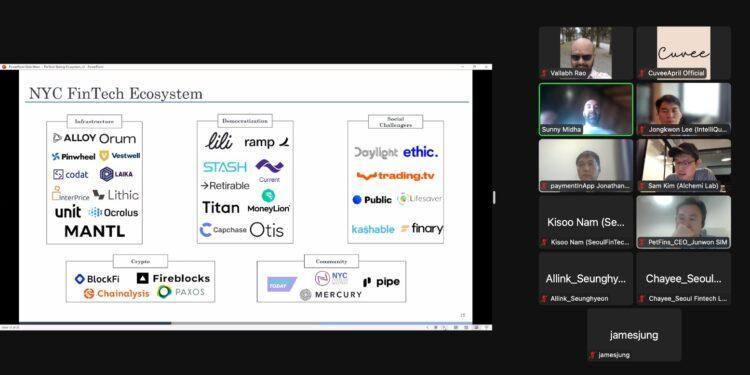

The Seoul FinTech Lab is hosting a 9-week “2022 Seoul FinTech Lab Global Accelerator Program” for fintech startups who wish to reach out to the global market and raise funding from foreign investors, specifically those in the United States. The program invites numerous investors and mentors of the global accelerators that will aid the startups in building a solid network to catalyze capital raising and international market entry. For this year’s program, seven startups have been selected to participate from June 8 to July 13, 2022.

What will the program’s main takeaway be for the participating startups?

– To improve IR Decks and Pitching skills over the 9-week program

– To enhance presentation skills through mock investor pitching sessions

– To support investor and accelerator pitching via private demo day with global VC/AC investors

– To publish foreign marketing articles of the participating startups

The main content of the program

Lectures & Talks:

The program will have lectures on the startup ecosystem and compliance/accounting, analysis of successful US market entry and investment attraction, and analysis of cases of successful acceptance to the accelerating programs in the United States. Also, there will be talks on data analysis on KPIs such as MRR, ARR, Churn rate, etc. and an introduction to the strategies for the sales and entry into the US market.

IR Workshops:

At the IR workshops, the startups will get feedback on delivering their products/solutions and identifying company issues. There will be suggestions on notable KPIs of a company and strategical ways of foraying into the US market.

Individual Feedbacks:

The program will also allow startup founders to have one-to-one feedback sessions with experts and mentors. There will be mock pitching sessions with a local professional investor.

Online Demo Day:

As the final feedback round, two privately held Demo Day events will be organized for the startups, one with investors from the United States and another with investors from Singapore.

The seven startups which are participating in the ‘2022 Seoul FinTech Lab Global Accelerator Program’ are as follows:

AlchemiLab

The startup provides crypto asset trading strategies based on DL and MPT (Modern Portfolio Theory). Currently, the Alpha Model is running on a website and has generated a return of 132% in the past 466 days. On May 10, 2022, the team launched an OEM service to a crypto platform and planned to launch a DIY quant building platform within the year.

Allink

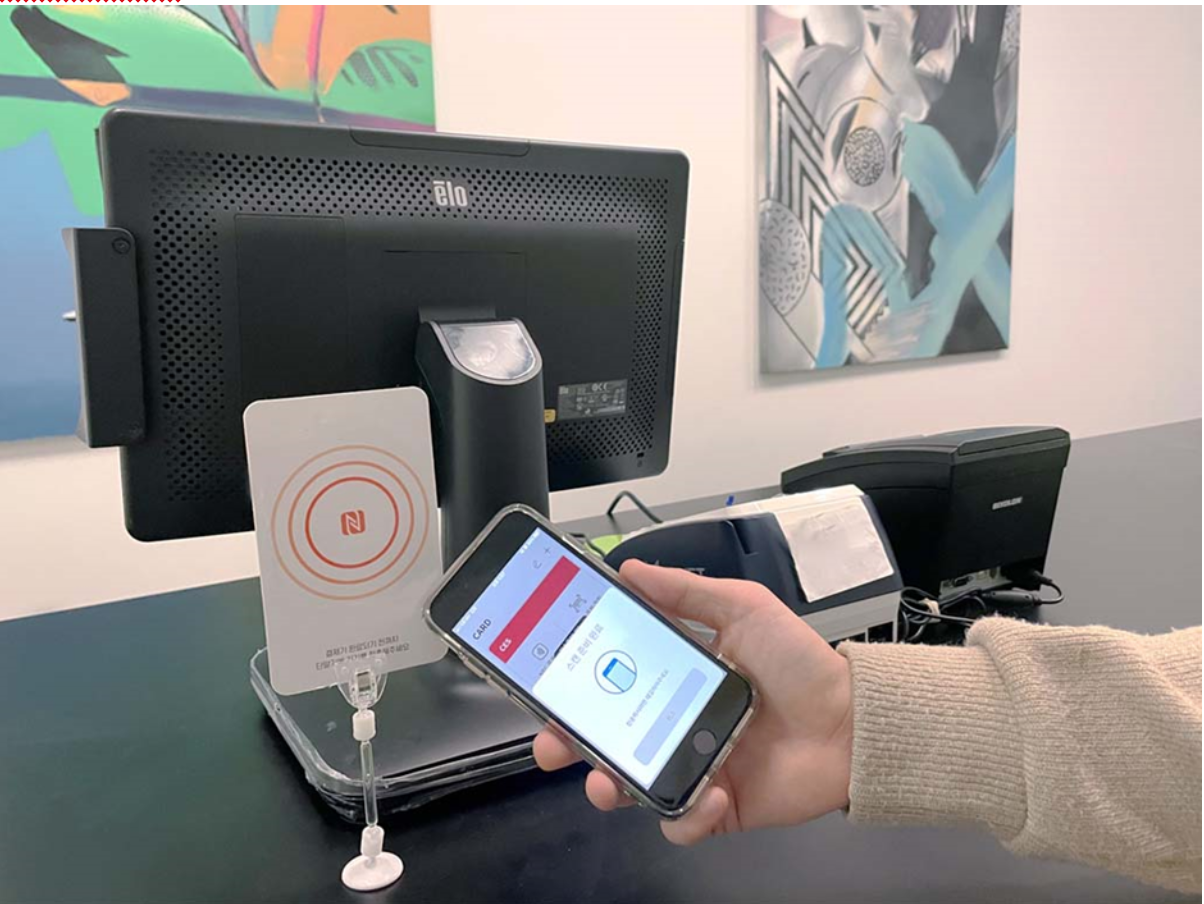

A company that provides virtual reader and scanner solutions for mobile services to connect freely with terminals. Allink’s NFC Tag-based Information Transfer Solution, nest+ap, is a white-label solution designed to support every mobile service with a cheap NFC Tag, simple tap and complete compatibility.

Innofin

A fintech company that collects, refines, and processes scattered financial data with its AI and big data technologies. TUDAL, Innofin’s investment information platform, provides smart investment information by analyzing core real-time financial data for retail investors.

IntelliQuant

IntelliQuant is a fintech startup providing algorithmic investment services based on Big Data and AI technology for financial and crypto-assets. “IntelliQuant” is a DIY quantitative investment platform that provides users with an environment for developing investment algorithms and where users can share a variety of algorithms in the marketplace to construct and manage customized strategy portfolios.

Paymentinapp

It provides Mobility-as-a-Service, Mobile IoT, and Artificial Intelligence-based Smart City Mass transit payment and big data analysis service. The startup’s ultimate goal is to provide better service than ‘Uber’ on Smart City, the Public Transportation.

Petfins

This startup is a pet financial platform for caring support and health data. A ‘pet account’ for lifelong petcare support is created, and various financial services are provided.

Spiceware

Spiceware securely protects all data operated by enterprises in the finance, public, telecommunications, and healthcare sectors. It provides data security and PII protection services for building infrastructure utilizing the cloud, big data, and AI.

Programs powered by Seoul FinTech Lab

Established in 2018, Seoul Fintech Lab provides customized support for the various needs of fintech startups and offers office space for up to 3 years. It is located at Yeoui-do, Seoul’s main finance and investment banking district, to promote the global competitiveness of fintech startups and to utilize the financial hub of the area. The accelerator started with 14 startups in 2018 and is supporting 100 startups as of 2021 and growing. Various programs that Seoul Fintech Lab conducts throughout the year are as follow:

(a) Mentor Program

The resident startups can either choose from the list of in-house mentors or request specific profiles from outside resources that the lab would later arrange.

(b) Education Program

Seoul Fintech Lab’s education program consists of “Fin Academy,” which covers subjects such as HR, investment, compliance, patents, marketing, UX/UI, R&D etc. and “Fin Class,” where entrepreneurs with at least one successful exit experience come and share their insights.

(c) Networking Program

This program is intended to foster the resident companies’ growth and contribute to the startup ecosystem within the FinTech industry through vigorous networking within our residency and across the open-source of other institutions and companies.

(d) Demo day Program

This Demo Day program allows the resident startups to have an opportunity not only to bring their business ideas out to the world but also to attract the attention of investors through pitching sessions.

(e) Scale-Up Program

The Scale-Up program diagnoses current company issues and increases investment capabilities through the support system backed by the specialists the lab has carefully picked.

(f) Global Program

The program has its root in assisting capital raising from the foreign market, the establishment of the overseas corporation, and consistent follow-up meetings with global investors and accelerators

(g) Recruiting Program

This industry-academic cooperation program deepens the networks to bring out the best outcomes and boost the quality of and ease the recruiting process.

(e) Open-Innovation Program

Open-Innovation allows startups to overcome the limitations of a single, independent entity and expects growth through collaborations between startups and established institutions such as conglomerates and traditional banking organizations.