South Korea has recorded a decline of 60.3% in venture investment during quarter one of 2023 compared to last year, owing to the bankruptcy of Silicon Valley Bank and uncertainty in the global financial market. The Korean government and private sector are scrambling to halt the damage being done by this contraction of the venture investment market, and opinions have been raised that the government needs to increase fundraising funds and provide intensive support in new growth fields like deep tech.

The domestic venture fund formation decreased by 78.6 % and investment performance in the first quarter of 2023 decreased by 60.3%, compared to last year. The Ministry of SMEs and Startups (MSS) and the Korea Venture Capital Association organized a ‘Venture Capital Forum’ on April 18th. Minister Young Lee of the MSS promised to support the innovative venture industry and revitalize the venture and startup ecosystem.

Minister of SMEs and Startups Young Lee said in his opening remarks, “Venture investment in the first quarter showed a significant decrease compared to the previous year, as expected, but compared to the same period in 2019 and 2020, it increased by 13-14%. From 2022, there is a need to consider the situation where there was a base effect following the unprecedented surge in investment.”

Minister Lee plans to focus all capabilities of the Ministry of SMEs and Startups to support overcoming the complex crisis faced by the innovative venture industry and to revitalize the venture and start-up ecosystem. The MSS will invest 1 trillion won of parent fund this year to create a parent fund of more than 2 trillion won, incentivizing management fees and performance fees so that venture capitalists can execute the investment capacity of about 11 trillion won as of the end of last year.

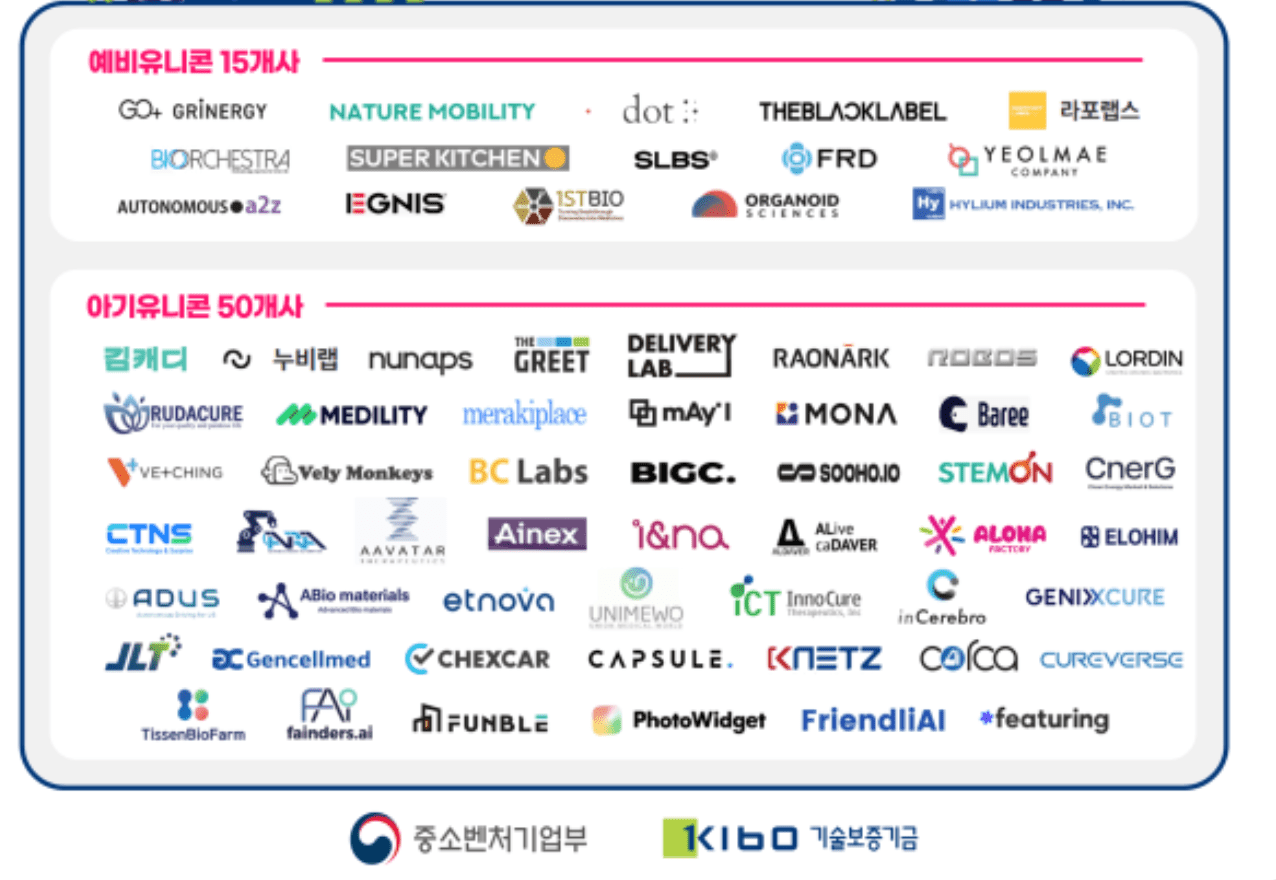

The Ministry will actively support the growth and global advancement of ventures and startups in the high-tech field by strengthening R&D in the deep tech sector, such as the Super Gap Startup 1000+ project, and through bold regulatory innovations, such as the introduction of global innovation special zone and expansion of global fund creation.

Yoon Gun-soo, head of the Korea Venture Capital Association, who participated in the forum, said, “The government should actively support companies with high growth potential, such as new growth industries. To overcome the crisis, it is necessary to go global, support deep-tech technology development, and innovate regulations.” During the panel discussion, Minister Lee agreed with the opinions suggested by the industry and said that the government would carefully review the various opinions from the forum and reflect them in policies related to ventures and startups.

In addition, the Financial Services Commission (FSC) has a separate plan to improve the funding conditions and enhance the competitiveness of ventures and startups. FSC Chairman Kim Joo-hyun held a meeting in April to review support initiatives by the state-operated financial institutions, such as the Korea Development Bank (KDB) and the Industrial Bank of Korea (IBK) and called for broader support to address the difficulties that startups face. The FSC will offer a policy finance program worth 205 trillion won ($155.3 billion) to the industry this year and provide 9 trillion won in funds to unicorns and small and mid-size enterprises designated as one of the five key strategic areas.

Also Read,

- Korean ventures & startups lead employment growth, especially for young people & women: Ministry Report

- 10 English-speaking Accounting firms in Seoul for Global Startups

- Unlocking the potential of the Korean market: Strategies for global startups to succeed

- Pangyo Techno Valley: A Thriving Startup Hub in Korea