In a decisive move to bolster the domestic venture ecosystem, the Financial Services Commission (FSC) of South Korea has unveiled a comprehensive plan aimed at enhancing support for early-stage venture companies. During a meeting on May 16, chaired by FSC Chairman Kim Joo-hyun, a series of initiatives were announced to drive growth and investment in the sector.

The centerpiece of the new measures is a substantial increase in customized policy financing for early-stage ventures. The FSC has committed to injecting KRW 15.4 trillion (USD 11.36 billion) into the venture market this year through key financial institutions, including the Korea Development Bank (KDB), the Industrial Bank of Korea, and the Korea Credit Guarantee Fund. This represents a 30% increase from last year’s allocation of KRW 11.8 trillion (USD 8.7 billion). The aim is to ensure that promising startups have sufficient funding from the early stages of their business development.

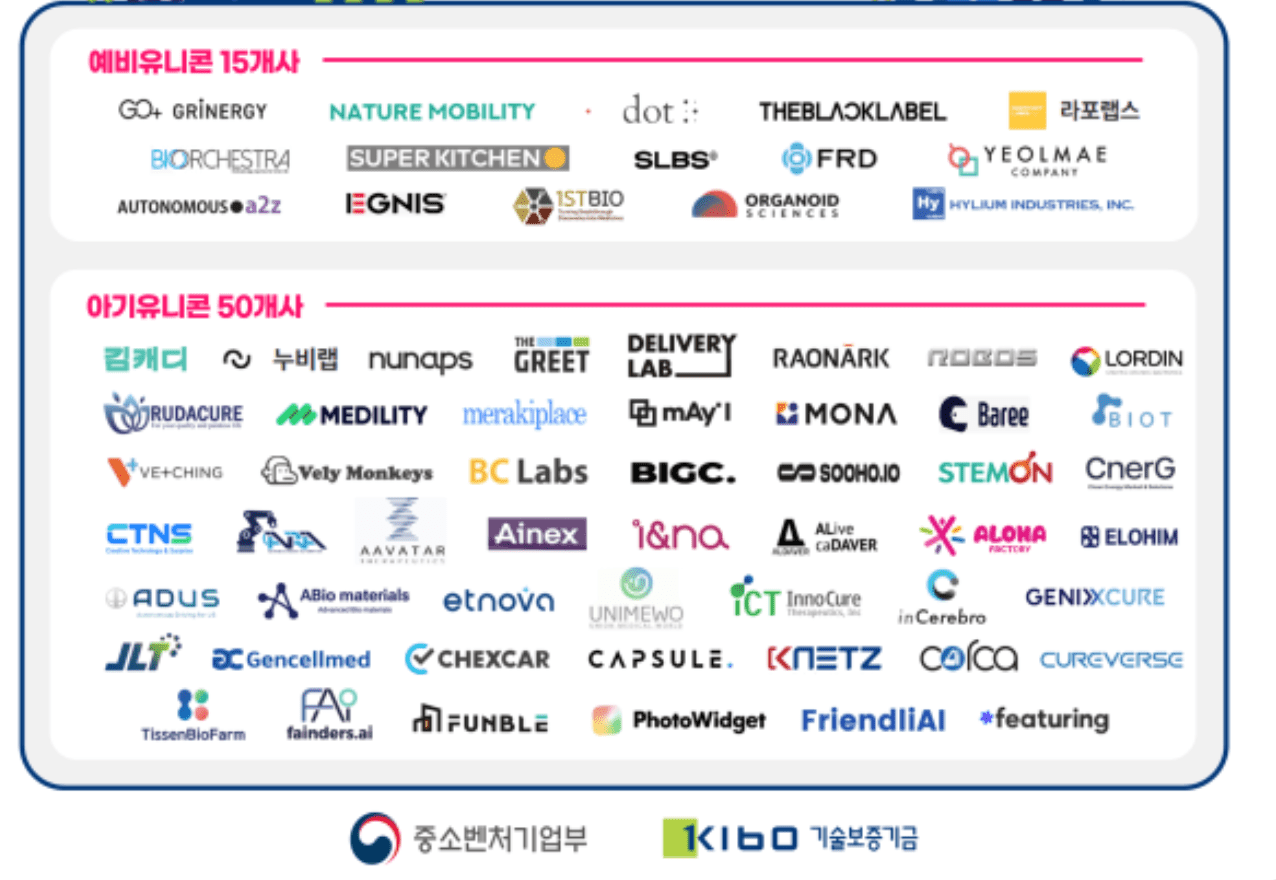

Fostering Early-Stage Startups

In addition to the increased funding, the FSC will create and invest more than KRW 500 billion (USD 368 million) over the next three years through the IBK Venture Investment program, which was launched last March. This initiative is designed to provide vital capital to startups during their critical early stages.

Chairman Kim said, “Unlike global venture investment, which focuses on investing in innovative ideas and technology commercialization of early-stage companies, Korea has a high proportion of investment in late-stage companies that have proven some level of performance (47.3% in 2023), thereby compensating for blind spots for early-stage companies.”

Enhancing M&A and IPO Markets

To support the M&A sector, the FSC has strengthened the functions of the IBK M&A Center, enhancing its capabilities in brokerage, arrangement, and advisory services. An additional KRW 300 billion (USD 221 million) has been allocated for acquisition financing to expedite transactions.

Furthermore, the FSC is taking significant steps to improve the market for initial public offerings (IPOs). This includes the establishment of a secondary fund worth KRW 1.2 trillion (USD 880 million) through a partnership between KDB and the Bank of Korea, which has been actively investing since May. Plans are also in place to institutionalize an unlisted stock trading platform currently operating as a sandbox, facilitating the sale of existing venture fund shares.

Regional and Global Expansion

To ensure regional equity in venture support, the FSC plans to launch additional venture business development platforms in Busan and Gwangju. These platforms will offer preferential products and expand guarantee-linked investments to support regionally based startups.

On the international front, policy financial institutions are ramping up efforts to support Korean ventures looking to scale globally. KDB is spearheading this initiative by organizing large-scale investor relations (IR) events and inviting overseas investors. This year’s KDB Next Round events have expanded to Tokyo, following successful sessions in Silicon Valley and other global tech hubs. These efforts include non-financial support such as office space, IR assistance, and consulting, leveraging overseas bases like IBK Changgong in Silicon Valley and Saarland in Germany.

Chairman Kim emphasized the importance of a holistic approach to building a robust venture ecosystem. He stressed the need for collaboration across government ministries, including the Ministry of SMEs and Startups, to provide detailed and practical support to startups. “To build a complete venture ecosystem, it is important to establish a detailed support system at the government-wide level as well as policy finance from the Financial Services Commission,” Kim said.

Keep tab on latest news in the Korean startup ecosystem & follow us on LinkedIN, Facebook, and Twitter for more exciting updates and insights.