South Korea’s fast-moving venture ecosystem makes launching a startup not just easier but also incredibly riskier. A growing number of founders are outsourcing app development to enter the market quickly, but many lack the in-house capacity to sustain growth. New data now shows how these low barriers are fueling high closure rates and exposing structural weaknesses in Korea’s venture ecosystem.

App Startups Proliferate, but Roughly One in Four Close Within Years

Korea’s venture ecosystem is seeing a surge of “easy entry” startups, particularly app-based ventures launched through software outsourcing firms. Yet data shows that this outsourcing startup model is proving unsustainable.

According to an analysis by Maeil Business Newspaper and venture investment information platform The VC, 730 app-based startups with fewer than five employees were founded between July 2015 and July 2025. Of these, 200 have already closed — a failure rate of 27.4 percent, or roughly one in four.

Outsourcing Model: Quick Launch, Short Lifespan

Entrepreneurs with little or no IT background can now pay outsourcing firms to develop apps that resemble TikTok-style platforms or integrate features such as Instagram-linked profiles.

In one case, an entrepreneur spent KRW 30 million (approx. US$22,000) to create an iOS prototype, with another KRW 30 million required for Android compatibility.

But then, the challenge comes after launch.

Because most outsourcing firms only deliver the requested product without providing updates or maintenance, startups are unable to adapt to user demands or shifting market conditions.

One founder closed her platform just six months after launch, noting that “customer tests revealed a need for new functions, but the contractor refused to update beyond the original scope.”

Another entrepreneur who attempted three app startups through outsourcing said the lack of an in-house team made it impossible to upgrade quickly or respond to customer feedback.

“The lesson is that real startups need teams of designers, developers, planners, and marketers working together,” he reflected.

Korean Software Outsourcing Market Keeps Growing

The heavy reliance on outsourcing is fueled by a rapidly expanding supply of software contractors.

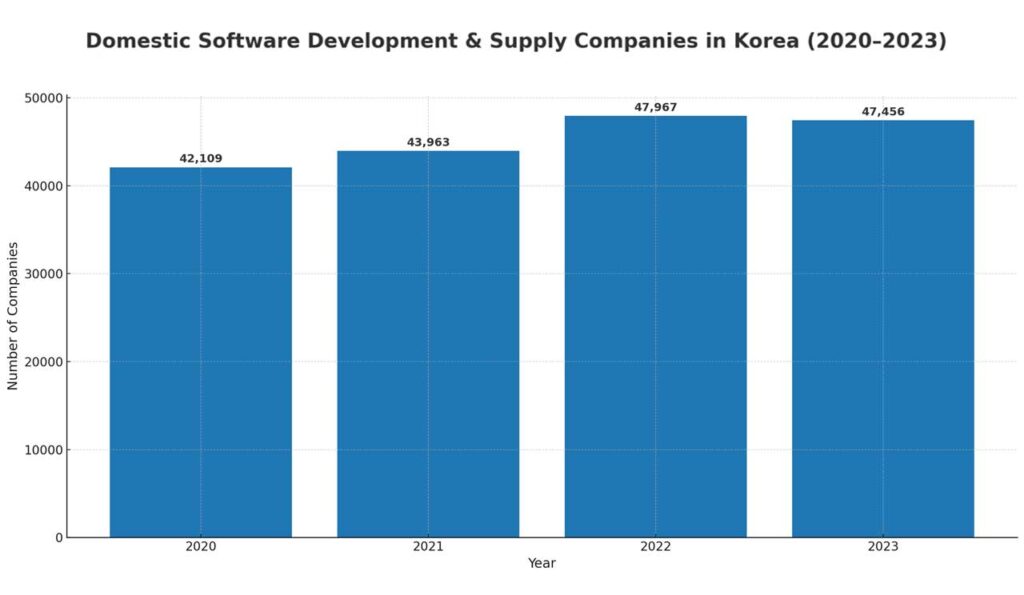

Statistics Korea reports that the number of domestic software development and supply companies is steadily growing:

- 42,109 companies in 2020,

- 43,963 in 2021,

- 47,967 in 2022,

- 47,456 in 2023.

These firms cover software planning, design, development, testing, sales, and maintenance across both application and system software.

But while the outsourcing market grows, the lack of in-house technical capabilities within startups increases long-term risk. Ventures without internal teams struggle to evolve beyond the minimum viable product stage, making them vulnerable to early closure.

Expert Warnings on Sustainability

Industry experts point to structural weaknesses in Korea’s startup ecosystem.

Lee Seong-yeop, professor at Korea University’s Graduate School of Technology Management, argued,

“If you launch an app business by outsourcing without any internal technical capacity, maintenance and updates inevitably become problems. Relying on external providers for core capabilities naturally raises the risk of closure.”

Similarly, Lee Jong-woo, professor of business administration at Ajou University, stressed,

“Apps are only a medium to reach customers; what matters is the business model. Many founders simply replicate existing online shopping malls or offline services as apps, which lack competitiveness. Without marketing to grow active users and content to sustain them, success is unlikely.”

Broader Implications for Korea’s Venture Ecosystem

The rising Korean startup failure rate among app-based ventures underscores a central challenge in the Korean startup ecosystem: low barriers may encourage experimentation, but they also magnify risks when teams lack in-house talent and rely exclusively on outsourcing.

The findings highlight a critical lesson for founders and investors alike. Building sustainable startups requires not only an initial product but also a long-term foundation of technical expertise, differentiated business models, and active user strategies.

Without these, Korea’s expanding outsourcing market may continue to fuel instability rather than resilience in the venture ecosystem.

Stay informed on Korea’s fast-moving startup and tech scene—follow KoreaTechDesk on social media: LinkedIn, X (Twitter), Bluesky, and Facebook for insights, funding news, and industry updates.